Dominion Files Updated Fuel Charge –to be effective on an interim basis beginning July 1, 2025,

Order Establishing Fuel Factor Proceeding issued May 12, 2025

Dominion filed its annual fuel factor rate updatebeginning July 1, 2025 through June 30, 2026 in Virginia on March 31, 2025. The fuel factor rate, if approved, will be in effect from July 1, 2025 through June 30, 2026. Dominion projects fuel costs of $1.958 billion, including energy related fuel and capacity related purchased power expenses, for the coming fuel year combined with a prior period under-recovery of $204.5 million for a total revenue requirement of $2.1628 billion. The Fuel Factor is collected on customers’ bills under Fuel Charge Rider A. (See below).

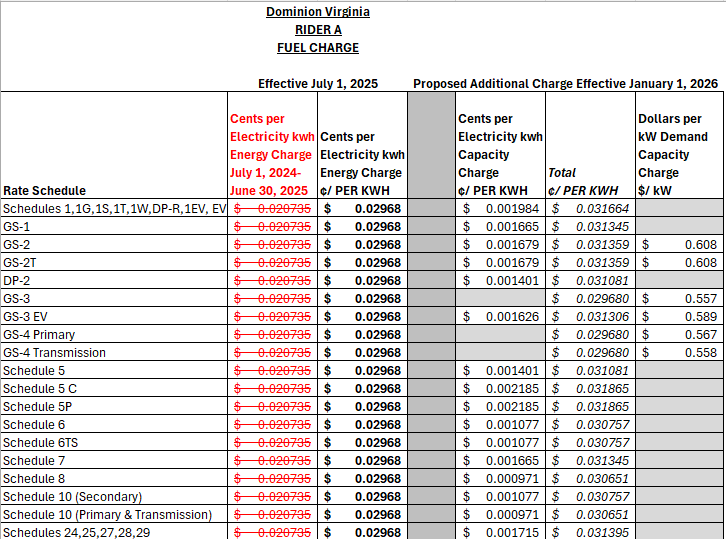

Dominion is proposing a change to the components and calculation of the Fuel Factor beginning with this fuel year. Dominion has proposed adding a capacity component to the annual fuel factor. Dominion is requesting a change to the recovery of capacity costs incurred, which have been historically collected through base rates in Virginia. The proposed 2025 fuel factor is $0.02968 per kwh energy charge plus an additional kwh or kw demand charge depending on your rate class and load factor. The additional charge pushes the residential fuel charge to $0.031664 per kwh and commercial customers can expect a similar charge on their bills. (See chart below). For comparison, last year’s fuel charge was $0.020735 per kwh. This new charge, if adopted, represents over a 50% increase in the fuel charge. AOBA reviewed a sample building, and the new fuel rate would represent an approximate 8-10% increase to the total bill.

In its Application, Dominion proposed that the capacity expense changes become effective with the new base rate changes in the biennial review beginning January 1, 2026, and include approximately $120 million of purchased capacity expense incurred from January 1, 2026 through June 30, 2026 in the fuel factor.

However, on May 12, 2025, the SCC ordered that “a total fuel factor rate of 2.9680 cents/kWh, with no capacity component, may be placed into effect on an interim basis for usage on and after July 1, 2025.” The SCC excluded the proposed capacity component adjustment of the fuel factor pending its decision in the biennial review. The current fuel charge is 2.0735 cents/kWh and will increase on an interim basis to 2.9680 cents/kWh – a 43% increase. The fuel factor rate ultimately approved by the SCC could be higher than the interim fuel factor rate if the Company’s proposal to move capacity-related purchase power expenses from base rates to the fuel factor is approved. The SCC determined that a procedural schedule for this fuel factor proceeding should be combined for all purposes including discovery, pre-filed testimony and hearing dates, with the Dominion Biennial Review. Testimony is scheduled to be filed in both cases in July and August, with hearings to begin September 2, 2025.

The Virginia State Corporation Commission established a procedural docket combining both the fuel factor change and the biennial review of rates, to the extent possible, to expedite the process.

Dominion’s request for revenue requirement approval in calendar years 2026 and 2027, for notices purposes, assumes that the purchased capacity expense recovery remains in base rates and is not transferred to the fuel factor as of January 1, 2026. Once the Commission rules on moving capacity charges to the fuel rate from base rates, Dominion will update its revenue requirement, so there is no double-counting.

In the interim, the Commission has permitted Dominion to update the fuel factor, effective July 1, 2025 to $0.02968 cents per kwh, which does not include any capacity components. For reference, the current Fuel Factor is $0.020735 per kwh for all rate classes, a 43% increase.